rhode island income tax rate 2021

Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. Find your gross income.

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

. The Department of Labor and Training DLT today announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022. Over 0 but not over 66200. Here you can find how your Rhode Island based income is taxed at different rates within the given tax brackets.

2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Exemptions to the Rhode Island sales tax will vary by state. If you make 80000 a year living in the region of Rhode Island USA you will be taxed 14583.

Individuals filing joint Rhode Island income tax returns incur joint and several liability for the Rhode Island income tax. For married taxpayers living and working in the state of Rhode Island. Rhode Island RI.

Calculate your state income tax step by step. Rhode Island Income Tax Calculator 2021. Divide the annual Rhode Island tax withholdings calculated in step 6 by the number of pay.

Tax rate of 599 on taxable income over 155050. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. DLT also announced that the 2021 Temporary.

Residents of Rhode Island are also subject to federal income tax rates and must generally file a federal income tax return by April 17 2023. If the Amount of Taxable Income Is. Rhode Islands tax system ranks 40th overall on our 2022 State Business Tax.

Income Tax Calculator 2021. 2020 rates included for use while preparing your income tax deduction. Tax rate of 375 on the first 68200 of taxable income.

2021 2456 40 homestead 3670 5580 3500 exemption value of exemption veterans 15300 disable vets 30700 elderly 51100. The latest sales tax rates for cities in Rhode Island RI state. Department of Labor and Training Announces Unemployment Insurance Tax Rates for 2022.

Rhode Island also has a 700 percent corporate income tax rate. Income Tax Calculator 2021 Rhode Island. Find your income exemptions.

The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax. How does Rhode Islands tax code compare. 648913 plus 599 of excess over 150550.

Published on Monday December 20 2021. By law the UI taxable wage base represents 465 of the average annual wage in Rhode Island. DO NOT use to figure your Rhode Island tax.

The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income. You will need to pay 6 of the first 7000 of taxable income for each employee per year which makes your maximum FUTA tax per employee per year 420Note that if you pay state unemployment taxes in full and on time you are eligible for a tax credit of up to 54 making your FUTA tax rate effectively 06. Rhode Island Tax Brackets for Tax Year 2021.

248250 plus 475 of excess over 66200. The UI taxable wage base will be 24600 for most employers and 26100 for employers at the highest rate. Each marginal rate only applies to earnings within the applicable marginal tax bracket which are the same in Rhode Island for single filers and couples filing jointly.

Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. Income Tax Calculator 2021 Rhode Island 193000. Sales Tax Calculator Sales Tax Table.

Rhode Island has three marginal tax brackets ranging from 375 the lowest Rhode Island tax bracket to 599 the highest Rhode Island tax bracket. Tax rate of 475 on taxable income between 68201 and 155050. The sales tax rate in Rhode Island is 7.

Residents and nonresidents including resident and nonresident estates and trusts are required to pay estimated taxes for each taxable year if the estimated tax can reasonably be expected to be 250 or more in excess of any credits allowable against the. Income Tax Brackets Rates Income Ranges and Estimated Taxes Due. The tax applies to the sale lease or rental of most goods and a number of services in the state.

The Amount of Tax Withholding Should Be. 4 rows The Rhode Island income tax has three tax brackets with a maximum marginal income tax. Read the Rhode Island income tax tables for Single filers published inside the Form 1040 Instructions booklet for.

Tax rate of 375 on the first 68200 of taxable income. Check the 2021 Rhode Island state tax rate and the rules to calculate state income tax. Over 66200 but not over 150550.

Find your pretax deductions including 401K flexible account contributions. Rates include state county and city taxes. There are no local city or county sales taxes so that rate is the same everywhere in the state.

Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7.

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Rhode Island State Economic Profile Rich States Poor States

Where S My Refund Rhode Island H R Block

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Limits Solar Power Property Taxes Pv Magazine Usa

A Progressive Civil War Is Brewing In Rhode Island The Boston Globe

Rhode Island Income Tax Brackets 2020

Rhode Island Income Tax Calculator Smartasset

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

Rhode Island Medical Marijuana Wholesale Market On Upswing Monopoly Questions Remain

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Income Tax Calculator Smartasset

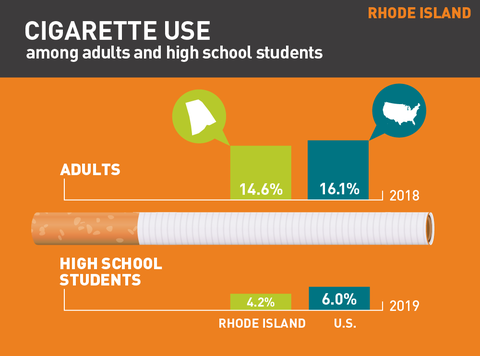

Tobacco Use In Rhode Island 2020

Here Are The U S States With No Income Tax The Motley Fool Income Tax States In America Income

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation